The 5 Best Precious Metal IRA Companies in 2023

March 23, 2023 - Written by Patrick Thompson

Though many investors favor traditional IRAs, savvy investors are now turning towards precious metals. Keep reading to learn more about the benefits of investing in a gold IRA and the best providers to work with.

Disclosure: We are a reader supported blog and may receive compensation if you purchase through the links on this website. However, this does not affect how much you pay or the integrity of our review. We simply choose the best options for retirees.

#1 Best for Rollovers

Goldco Precious Metals

Rated 4.8/5 Stars Overall

#3 Best Customer Feedback

Augusta Precious Metals

Rated 4.7/5 Stars Overall

#3 Best Buyback Program

American Hartford Gold

Rated 4.6/5 Stars Overall

Investing in precious metals can be complex and intimidating, but working with a reputable precious metal IRA company can make all the difference. These companies can help individuals navigate the process and ensure they are making informed decisions. It is important to choose a trustworthy, transparent company with a track record of providing quality service.

The companies listed in this article have been carefully researched and evaluated based on their fees, security measures, customer reviews, and more.

Whether you are a seasoned investor or just starting, this guide will help you find the best precious metal IRA company for your investment needs.

The Best Gold IRA Companies for 2022

Company | Best For | Header |

|---|---|---|

#1 Goldco Precious Metals | Best for Rollovers | |

#3 Augusta Precious Metals | Best Client Feedback | |

#3 American Hartford Gold | Best Buyback Program | |

#4 Birch Gold Group | Best Education | |

#5 Noble Gold Investments | Lowest Minimum |

#1 Best Client Feedback

4.9/5 Rating

#2 Best Pricing

4.8/5 Rating

#3 Best Buyback Program

4.7/5 Rating

#4 Best Education Options

4.5/5 Rating

#5 Lowest Minimum

4.3/5 Rating

The Best Precious Metal IRA Companies Continued:

#1 Goldco Precious Metals

Best Pricing, Best Customer Service

Rated 4.9/5 Stars

Key Features

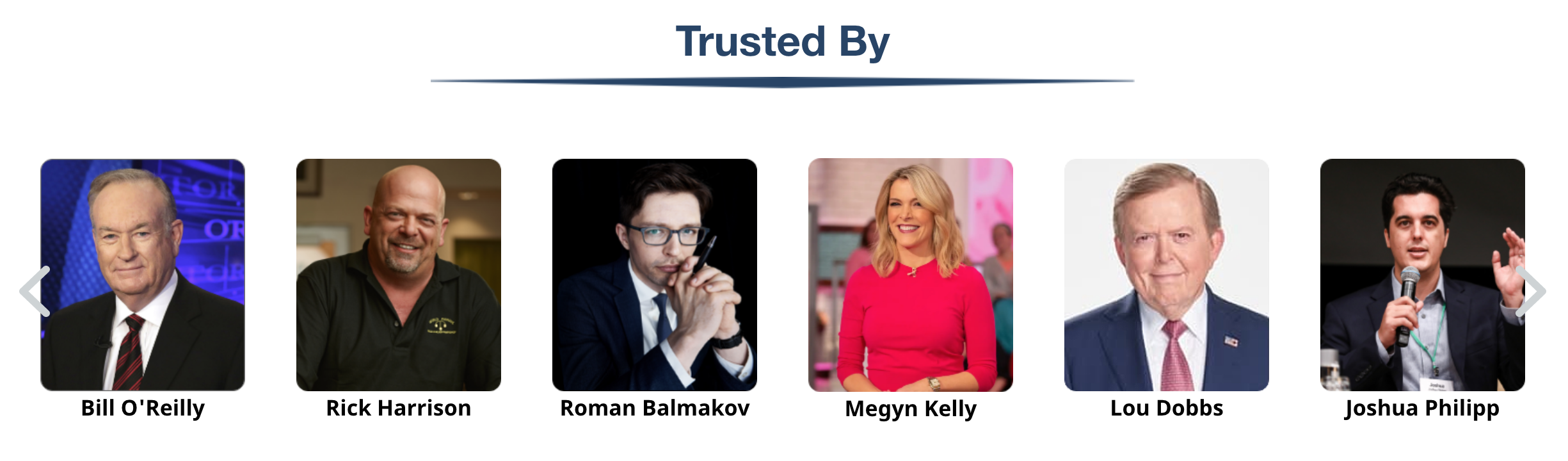

Goldco Precious Metals is one of the most well-known gold and silver IRA companies in the United States.

They have made a name for themselves with top-tier customer service, low fees, transparent processing, and stellar customer service.

About Goldco:

Goldco Precious Metals was founded in 2006 with the mission of helping investors diversify their portfolio and secure their retirement funds with gold and silver.

Goldco now offers gold, silver, platinum, and palladium to their IRA investors, which allows you to invest in only one metal, or a customized combination of the metals of your choice.

Trevor Gerszt is the founder and owner of Goldco; he has decades of experience in wealth and asset protection which plays a large part in Goldco's mission and processes.

Goldco is at the top-tier for business ratings in the IRA industry: they maintain an A+ with Better Business Bureau, an AAA with the Business Consumer Alliance, and a 4.8 on TrustPilot.

Who is Goldco Precious Metals Best For?

Goldco Precious Metals is best for the specific investors who:

Fees & Minimum Investment

Fees: $175-$230/year

Investment Minimum: $25,000

Promotions: Up to $10k in free silver

Pros

Cons

#1 Goldco Precious Metals

Best for 401k & IRA Rollovers

Rated 4.8/5 Stars

Key Features

About Goldco Precious Metals

Goldco Precious Metals was founded in 2006. Their mission is to "help Americans achieve greater financial security by providing effective solutions that can help protect their retirement."

Goldco has gold, silver, platinum, and palladium metals for IRA investments. This gives you the option to diversify your precious metal investment or just choose a single metal such as gold.

Their experienced staff has decades of experience in asset protection which coincides with their mission. With the economic and currency issues we face in 2023, Goldco has seen a huge uptick in customers looking to invest in assets with intrinsic value.

Goldco is in the top 1% for business ratings in the IRA industry. They are rated with an A+ by the Better Business Bureau, an AAA with the Business Consumer Alliance, and a 4.8 by TrustPilot.

Who is Goldco Precious Metals Best For?

Fees & Minimum Investment

Annual maintenance fee:

Set up Fee:

Investment Minimum:

$100

$50

$25,000

Pros

Cons

#2 Augusta Precious Metals

Best Client Feedback

Rated 4.7/5 Stars

Key Features

About Augusta Precious Metals

Augusta Precious Metals is a precious metal IRA company that offers a wide range of investment options to help clients protect and grow their wealth. The company leads with an education-forward approach, offering one-on-one web conferences with their Harvard economist.

One of the key benefits of Augusta Precious Metals is its commitment to customer service and education. The company offers a dedicated team of investment professionals who provide personalized attention and support to each client, helping them navigate the complex world of precious metal investments and make informed decisions.

Another advantage of Augusta Precious Metals is its focus on offering transparent pricing with no hidden fees or costs, which gives clients complete visibility into the cost of their investments. The company also ensures the safe and secure storage of precious metals through partnerships with top-rated storage facilities.

Who is Augusta Precious Metals Best For?

Augusta Precious Metals is the best option for investors with a higher investment as their minimum is $50,000.

Fees & Minimum Investment

Fees:

Investment Minimum:

Promotions

$180 per year

$50,000

Fees waived for up to 10 years

Pros

Cons

#3 American Hartford Gold

Best Buyback Program

Rated 4.6/5 Stars

Key Features

About American Hartford Gold

American Hartford Gold is a well-established precious metal IRA company with great brand recognition. The company is dedicated to helping clients invest in precious metals to hedge against current market risks and fiat currency issues.

American Hartford Gold offers a wide range of investment options to help clients diversify their portfolios according to their financial goals. The company's team of experienced investment professionals provides personalized attention and support to each client, ensuring that they make informed investment decisions.

The team also provides transparent pricing with no hidden fees or costs, allowing clients to have complete visibility into the cost of their investments.

In addition to its investment services, American Hartford Gold also ensures the safe and secure storage of precious metals through partnerships with top-rated storage facilities. This helps to provide clients with peace of mind knowing their investments are stored in a secure and protected environment.

Fees & Minimum Investment

Fees:

Investment Minimum:

No listed

$10,000

Pros

Cons

#4 Birch Gold Group

Best Education

Rated 4.5/5 Stars

Key Features

About Birch Gold Group

Birch Gold Group specializes in selling physical gold, silver, platinum, and palladium in the form of IRAs. The company offers a variety of investment options to meet the needs of its clients and has a low startup investment.

One of the key benefits of working with Birch Gold Group is its commitment to customer service. They provide personalized guidance to help clients understand the benefits of investing in precious metals and offer a variety of resources to support their clients' investment decisions.

Another benefit of working with Birch Gold Group is their expertise in the precious metal market. The company has been in business for over a decade, and its team of experts has a deep understanding of the market, providing clients with valuable insights and advice.

Finally, Birch Gold Group is committed to transparency and security. All transactions are handled through secure and insured storage facilities, and clients can take physical possession of their investments anytime.

Fees & Minimum Investment

Fees:

Investment Minimum:

$150 per year, $50 setup fee

$10k

Pros

Cons

#Noble Gold Investments

Cryptocurrency options

Rated 4.5/5 Stars

Key Features

About Noble Gold

Noble Gold Investments is a precious metal investment firm that provides clients with gold and silver investment opportunities. The company's mission is to assist clients in preserving their wealth through precious metal investments.

The product that Noble Gold Investments offers is an investment in gold and silver, either in physical form or in paper form. Clients can purchase physical gold and silver coins, bars, or rounds and invest in gold and silver ETFs.

One of the key benefits of investing with Noble Gold Investments is the ability to diversify an investment portfolio. Precious metals have historically held their value and can serve as a hedge against market volatility and inflation. Additionally, owning physical gold and silver provides privacy and security, as precious physical metals can be stored in a secure facility or a safe deposit box.

The investment firm also offers clients the ability to purchase precious metals with their IRAs, allowing them to save for retirement while also gaining exposure to the precious metals market.

Fees & Minimum Investment

Fees:

Investment Minimum:

Not stated

$10,000

Pros

Cons